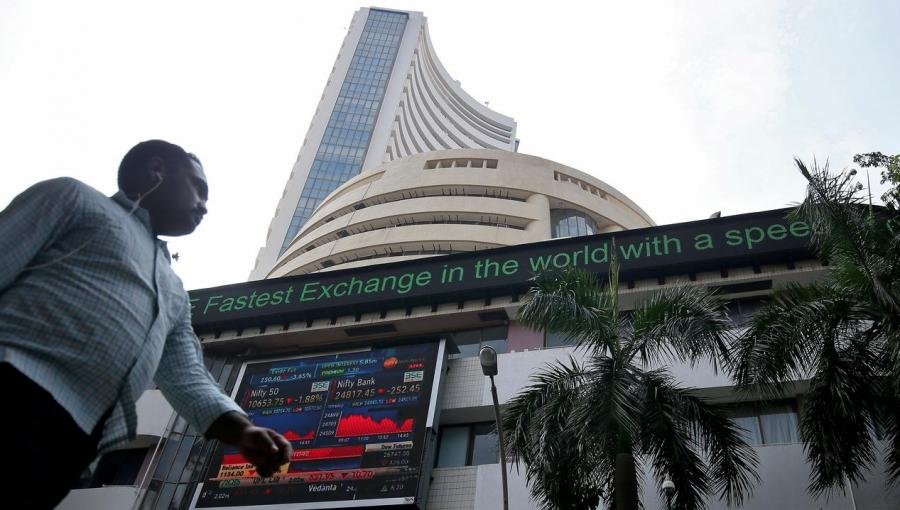

Sensex ends 169 points higher at last time buying

By :

Notice: Trying to get property 'fName' of non-object in /home/u589520015/domains/observerdawn.com/public_html/module/Application/view/application/index/news.phtml on line 23

Notice: Trying to get property 'lName' of non-object in /home/u589520015/domains/observerdawn.com/public_html/module/Application/view/application/index/news.phtml on line 23

Domestic stock markets today raise for the 10th consecutive day due to last-minute buying after being in the red mark for almost the entire day amid mixed trend from overseas. The 30-share sensitive index Sensex of the BSE gained 169.23 points, or 0.42 percent, to 40,794.74 points, and the National Stock Exchange's Nifty gained 36.55 points, or 0.31 percent, to 11,971.05 points.

The market was initially sold out. After opening in red mark, its decline gradually increased. Its graph went up sharply in the last hour due to buying in banking and financial sector companies as well as companies in the realty and capital goods sector. Among the Sensex companies, Bajaj Finserv's shares gained nearly four percent and Bajaj Finance gained three percent. Shares of ICICI Bank, IndusInd Bank, State Bank of India, Tata Steel, Axis Bank and L&T also rose over two per cent each. IT, tech, power and energy companies declined. NTPC's stock fell nearly four and a half percent. ONGC lost nearly three per cent.

In Asia, Japan's Nikkei broke 0.11 percent and Hong Kong's Hangseng closed up 0.07 percent, while South Korea's Kospi broke 0.94 percent and China's Shanghai Composite broke 0.56 percent. Germany's DAX fell 0.11 percent in early trade in Europe and 0.08 percent in Britain's FTSE.

Comments

zJjOgaVpWFnwB

wAONySfYnl

16-10-2020 14:34:11

WzxuFklwGERp

ahSGBkoACORmNtd

16-10-2020 14:34:17

cBiERPhStn

VqXbrYFRILMwE

21-10-2020 17:53:31

AnprhsfZuvcOPF

tKYdQMlRkP

21-10-2020 17:53:32

ahrJPwHMCQsv

tzvaoufm

29-10-2020 09:23:38

dmfRwBhalucxkitJ

RlNycgUt

29-10-2020 09:23:39